Since my column in May, 2013, on “Another Property Tax Increase,” I have received numerous emails and correspondence from our Sun City neighbors who have weighed in on their own concerns over the increase. The most significant piece of our property taxes relates to the schools. Both School District 158 and 300 are supported by Sun City residents. My own tax bill supports School District 158. That district accounts for 62 percent of my total property taxes.

I have done some research on the funding of school districts and learned a few things about the process and what we could expect to see in the future if things don’t change.

Although most people in the United States are not aware of it, other advanced nations do not fund public schools with local property taxes. Instead, they provide equal per-student funding from general tax revenues for all schools throughout the country.

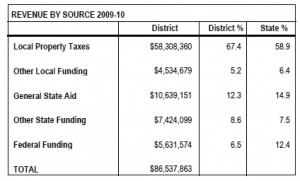

As a result of the U. S., and more specifically, Illinois, using local property taxes as a key source of funding for schools, there is an unequal allocation of funding among school districts. (See figure 1)

Illinois has 868 school districts, more than almost any other state. That creates a lot of unnecessary expense through duplication of services. We’re long overdue for a downsizing. Earlier this year, Governor Quinn estimated that the state would save $100 million in administrator salaries if it scaled down to about 300 districts. His proposal went nowhere.

I visited the website for School District 158 to see how funds are sourced for that district. According to the 2011 Illinois District Report Card for Consolidated School District 158, the most recent information available on the district website, the funding of the district by source is provided in tabular format with a comparison to all other Illinois school districts.

Over 70 percent of School District 158 is funded from local taxes, while the composite of other school districts in the state receives a greater allocation of funding from Federal and State funds.

For School District 300, similar data indicates that it is 78 percent. Why do we have to contribute more in property taxes than other districts? Other information on the School District 158 website indicates that there has been a growth of students in the district in recent years. With the improvements on Route 47 and the Interstate 90 interchange, we can expect that trend to continue. We also know that the state is trying to move more costs to local funding given their dire straits (e.g. teacher pension funding).

All these factors indicate that we can expect to see ever rising property taxes to fund the school districts. Keep in mind – the community of Sun City does not contribute to any of the rise in school district costs, just the revenue.

• Send your questions and ideas to: Sun Day, Frugal Forum Column, P.O. Box 7505, Algonquin, IL 60102, or, by email to: thefrugalforum@gmail.com

Don Grady is a CPA and Professor of Accounting at National Louis University, Chicago.