I am glad we no longer have debtor’s prisons as England did during Charles Dickens’s day, because my friend Carol might be sent to the slammer because of that huge debt she owes to her insurance company.

Her finances are tidy and orderly — or at least she thought they were. She bundles her mortgage, property tax and home insurance into an escrow account, and when they all come due, the bank writes a check. Done and done.

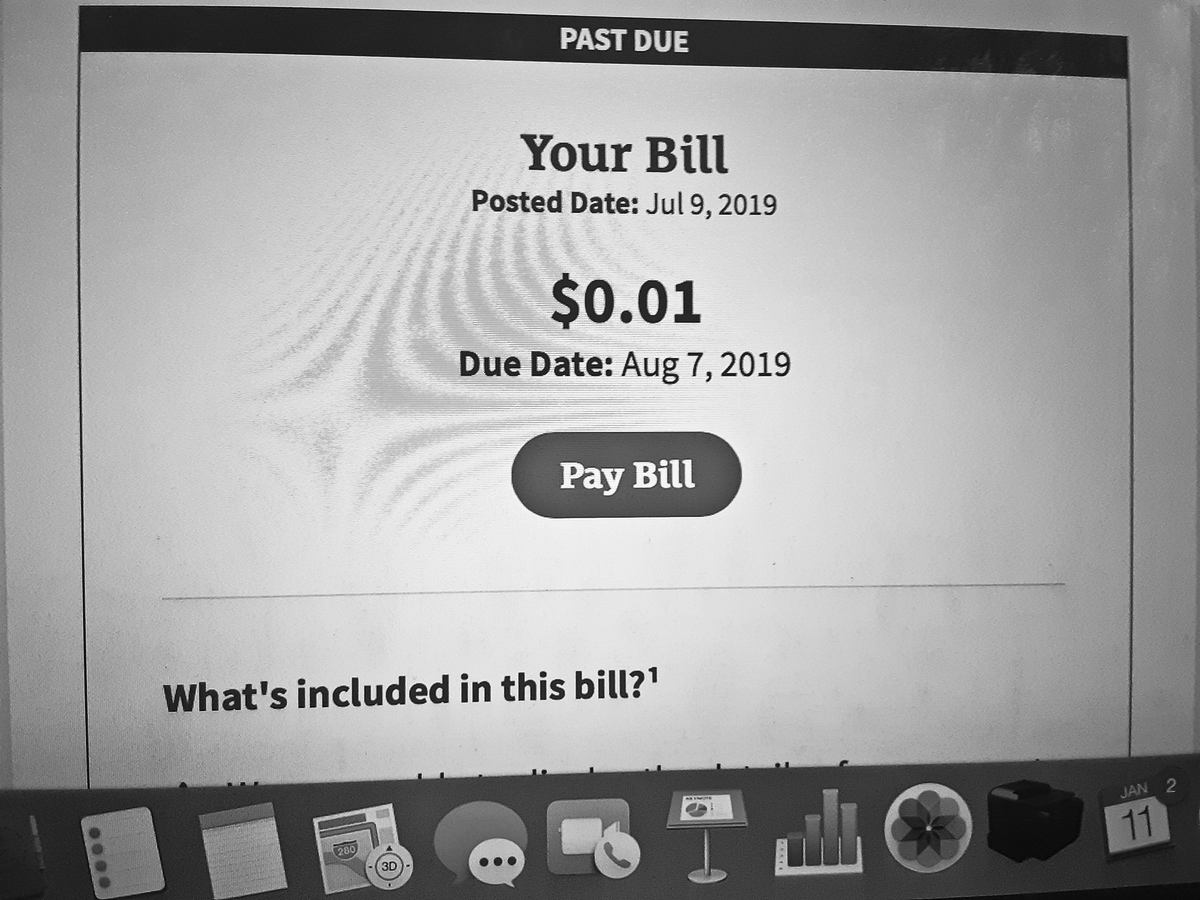

But she recently got a note from her insurance company, claiming that she had underpaid this year, and they were demanding that she pony up for the shortfall. They sent her a bill for one penny, and a deadline date for when they wanted to see it. The due date was already five months past.

Panic ensued. What might they do over her penny-ante delinquency? Would her insurance be invalid? Might her credit rating plummet? Could the feds fine her for not paying her full homeowner’s tax on time? Foreclosure and a dreary life on the streets?

She called her mortgage company, which answered with a friendly voice assuring her how important her call was to them, and to listen carefully because their options had changed. She picked a number, clicked it, and listened to the music as she waited for someone to pick up.

Thirty-five minutes later, an agent answered and she explained her dilemma. “Oh, no,” the man said, “we don’t do that in this department.” The man gave her another number to call to have a new bill re-issued, “but of course they will charge you a fee to do that.”

She asked if the bank might just send a second check for one penny, and they said they would be glad to do that — for a second-billing fee. But still, nobody could explain who was responsible for sending the first check with an amount that was one penny short of the total due this year, or whether it wouldn’t happen again and again, year after year, making her a chronic delinquent ad infinitum, until her children and grandchildren had to change their last name out of shame.

When she told me her tale of woe, I said, “Why not just mail them a penny? Better yet, mail them a dime. Tell them to apply the excess to next year’s bill, and the next, and the next, to cover a decade of under-payment.” It would cost her a half-buck for the postage stamp, but she could sleep easy for the next decade.

Then again, maybe the FDIC doesn’t allow a bank to hold on to the overage of a too-big payment. Maybe they would have to write her a check for the extra nine cents, and she didn’t want to put her bank through all that trouble, or to spend a dollar’s worth of gas to go cash a nine-cent check.

After a sleepless night, Carol picked up her phone again and this time called her home insurance company. The voice on the end of the line assured her how important her call was to them, and to listen carefully because their options had changed. She hit a button and listened to the music play as she waited for someone to pick up.

Heather answered, and Carol explained her dilemma. Would she be denied a claim if something happened to her house and they found out that she hadn’t paid her premium fully? “Oh, we don’t do that in this department,” Heather said, and she gave Carol the number for Billing.

“Just send them the damn penny,” I said when she told me. “Hell, send them a dollar — in pennies. Tell them to keep the extra 99 cents as compensation for their trouble.”

But Carol is a nicer person than I am. She wouldn’t want to drop a problem like that in somebody else’s lap.

At last report, she was planning on picking up the phone to call Billing, and she was settling in with a bracing cup of coffee because she knew how important her call was to them, and that she would have to listen carefully because their options had changed. She hoped she would get a nice song to listen to for a half-hour or so.

Anyway, I hope she doesn’t get evicted, and I hope her children and grandchildren won’t have to change their last names out of shame, and I hope nothing like this ever happens to me.

Because I don’t have as much patience as Carol does with banks that have all of your money, but none of your common cents.

Author, musician and storyteller TR Kerth is a retired teacher who has lived in Sun City Huntley since 2003. Contact him at trkerth@yahoo.com. Can’t wait for your next visit to Planet Kerth? Then get TR’s book, “Revenge of the Sardines,” available from Amazon, Barnes & Noble, and other online book distributors.