Since 1968, AARP Foundation Tax-Aide has provided free tax help to over 78 million taxpayers, focusing on older adults. Tax-Aide volunteers are trained and IRS-certified every year to ensure they know about and understand the latest changes and additions to the tax code.

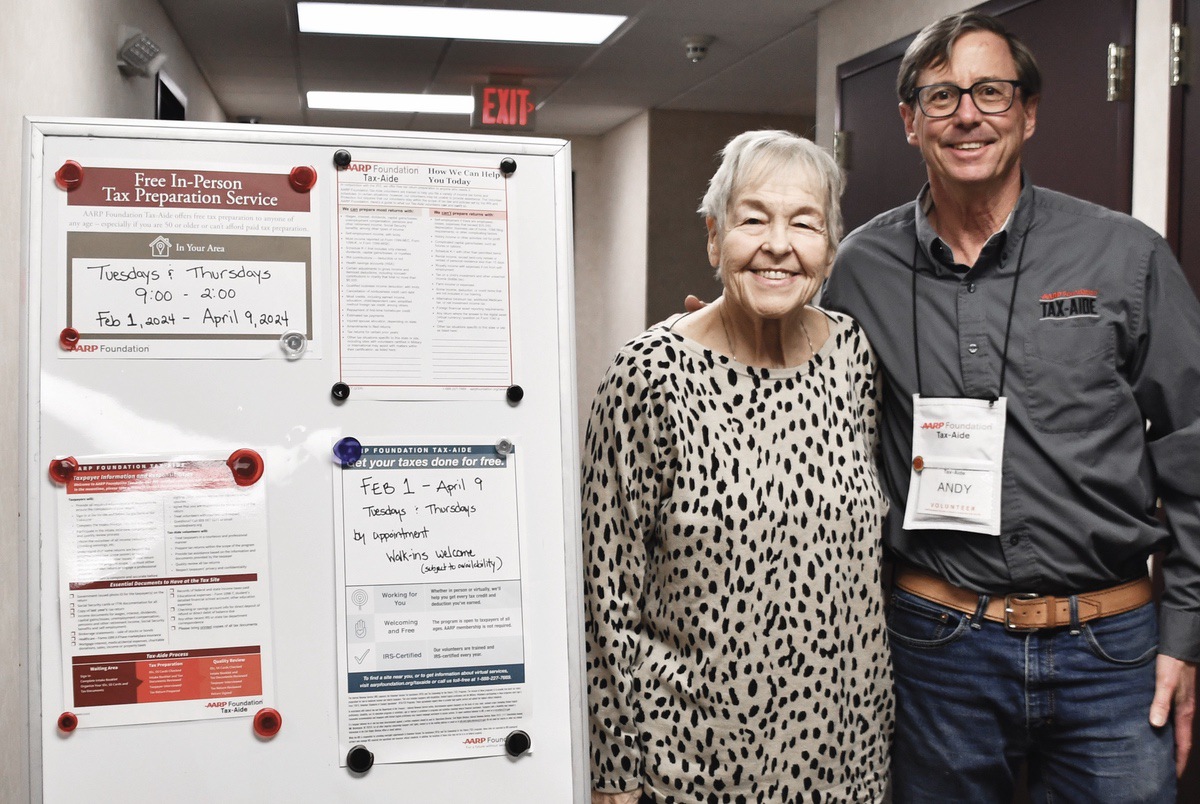

Andy Snarski, local coordinator for AARP Foundation Tax-Aide Volunteers in Huntley, is helping seniors file tax returns electronically. Heartland Bank has provided space in the lower building level at 12101 Regency Pkwy, Huntley, IL.

Snarski said, “We have ten volunteers working at this location. Most of them have many years of experience. We are here Tuesdays and Thursdays from 9:00 a.m. to 2 p.m. until April 9. You need to make an appointment in person. When you make an appointment, you will get a sheet with information needed to prepare the tax return.”

The trained AARP Foundation Tax Aide will get your tax returns filled out and filed electronically, all for free.

Snarski said, “We prepare and review the returns for accuracy. They are filed electronically. You can also pay electronically and deposit your refund directly into your account. We also provide extra copies for senior tax assessment freezes.”

Senior homeowners are eligible for the senior assessment freeze in Illinois if they are over 65 and have a total household annual income of $65,000 or less in the 2023 calendar year. A Senior Freeze Exemption saves property tax by freezing an eligible property’s equalized assessed value (EAV). Exemption applications for tax year 2023 will be available in early spring. The second installment tax bill only reflects property tax savings from exemptions.

Snarski said, “The program is free and doesn’t require AARP membership.”

To get help preparing your tax return from an IRS-certified volunteer, book an appointment by coming to Heartland Bank on Tuesdays or Thursdays between 9 a.m. and 2 p.m. But you need to do more than walk in empty-handed or with an envelope full of receipts. You can check what you need to bring online at https://www.aarp.org/money/taxes/info-01-2011/important-tax-documents.html.

AARP Foundation Tax-Aide volunteers can help with most, but not all, tax returns. They do not offer tax preparation for extremely complicated return, such as one that involves a small business with employees, rental income, or alternative minimum tax (AMT).

Snarski said, “We take almost anyone that walks through the door. There is no age requirement or income limitation. We would not discourage anyone from coming in and making an appointment. Four other locations host the program. Algonquin, Woodstock and McHenry Libraries and Algonquin township.”

Snarski expects about six hundred returns to be prepared and filed at the Huntley location.